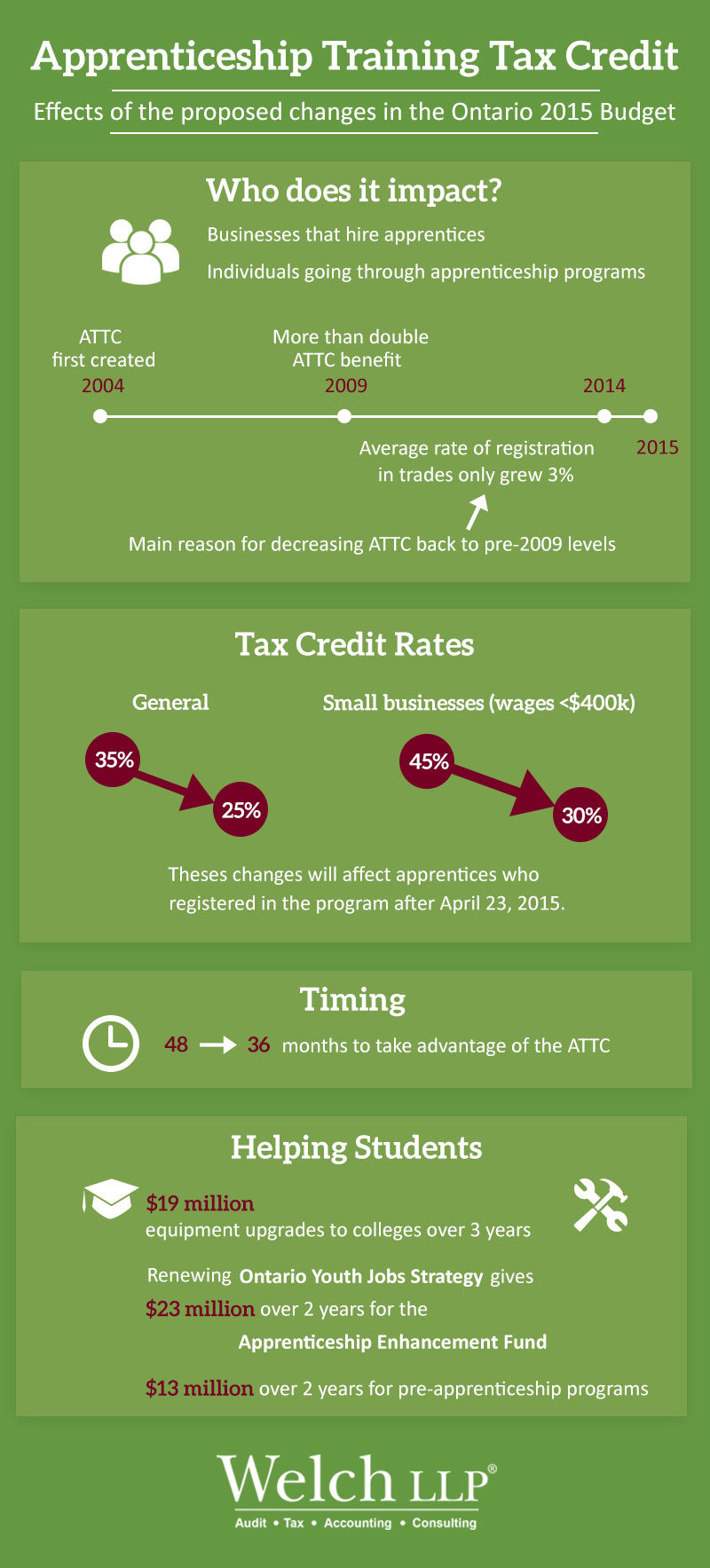

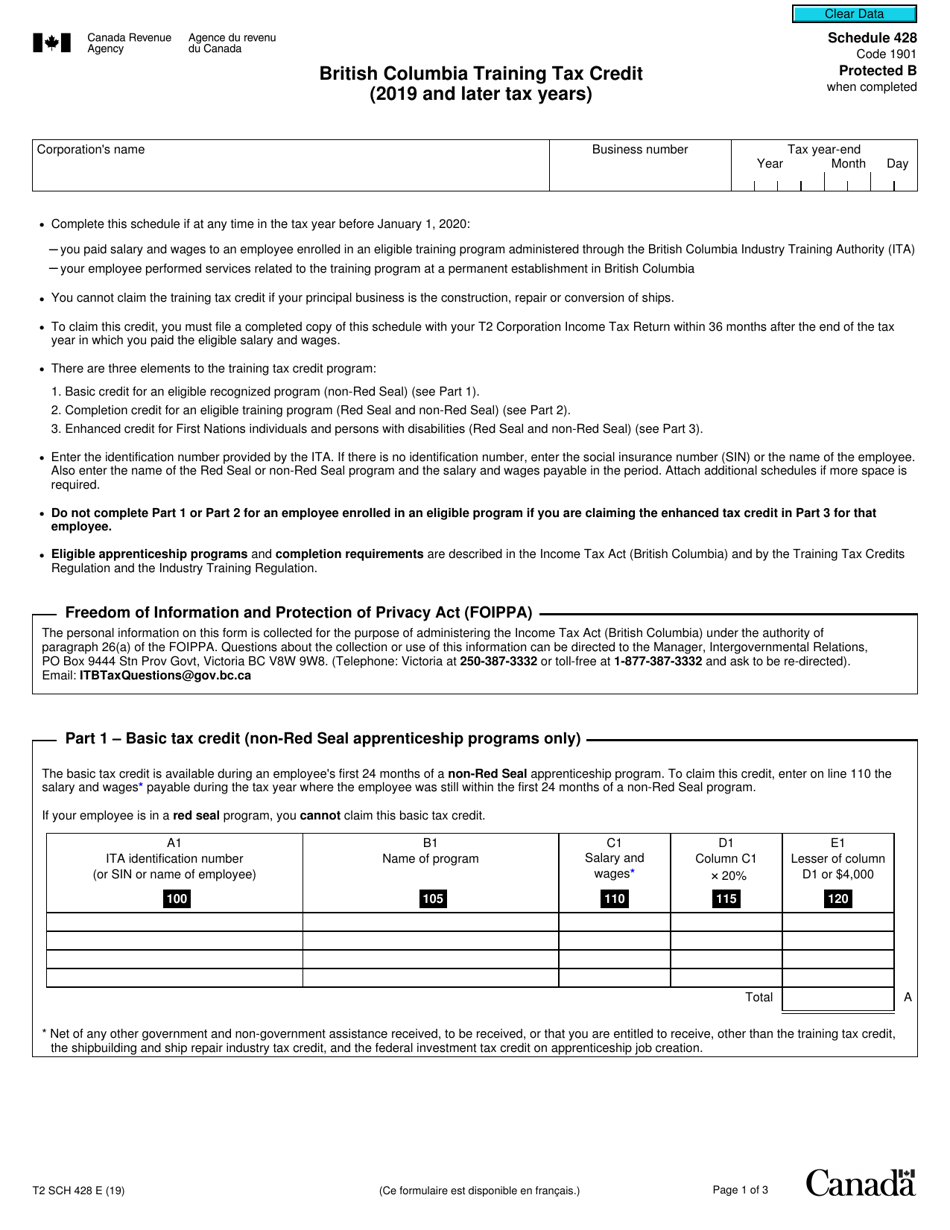

Claiming the credit. File Schedule 428, British Columbia Training Tax Credit, with your return.. On line 679 of Schedule 5, Tax Calculation Supplementary – Corporations, enter the total amount of the credits you are claiming.. You must claim: the basic tax credit and the enhanced basic tax credit no later than 36 months after the end of the tax year in which the eligible salaries and wages.. The training tax credit has been extended until December 31, 2024. The shipbuilding and ship repair industry tax credit has been extended until December 31, 2024.. The BC family benefit and the BC climate action tax credit are fully funded by the Province of British Columbia. For more information, call the CRA at 1-800-387-1193.

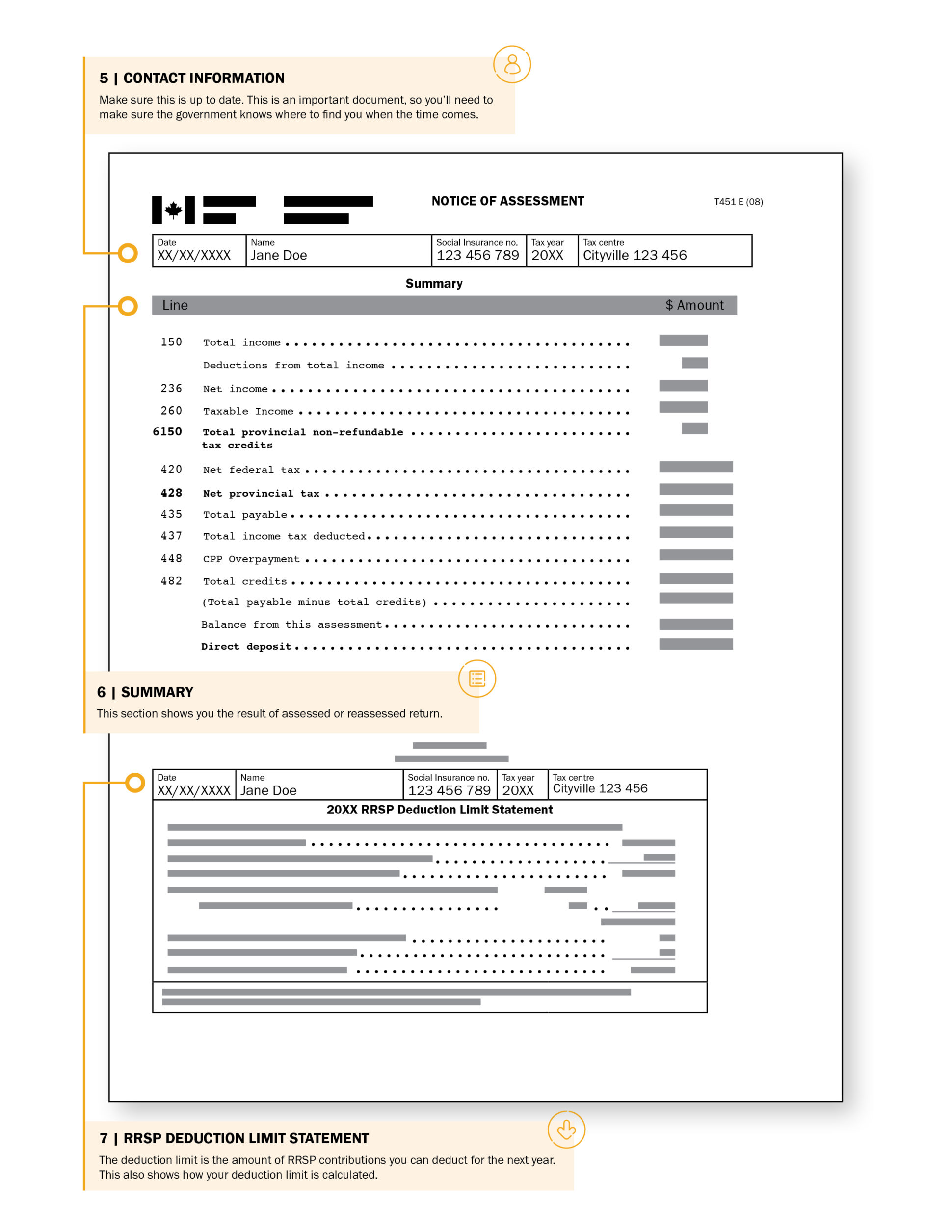

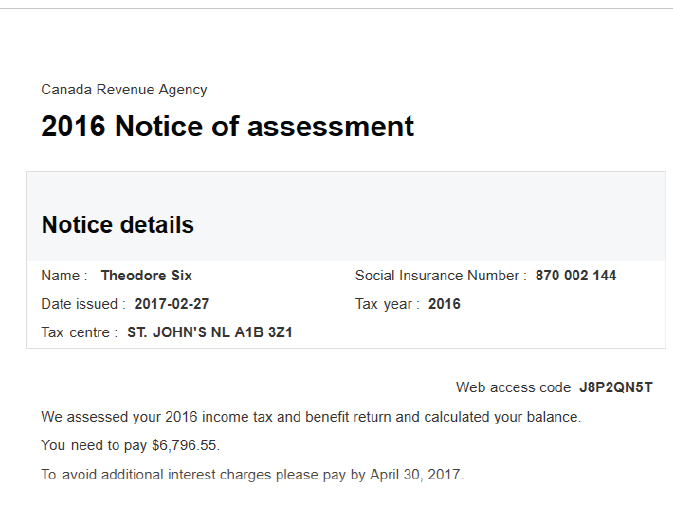

What your Notice of Assessment means Credit Unions

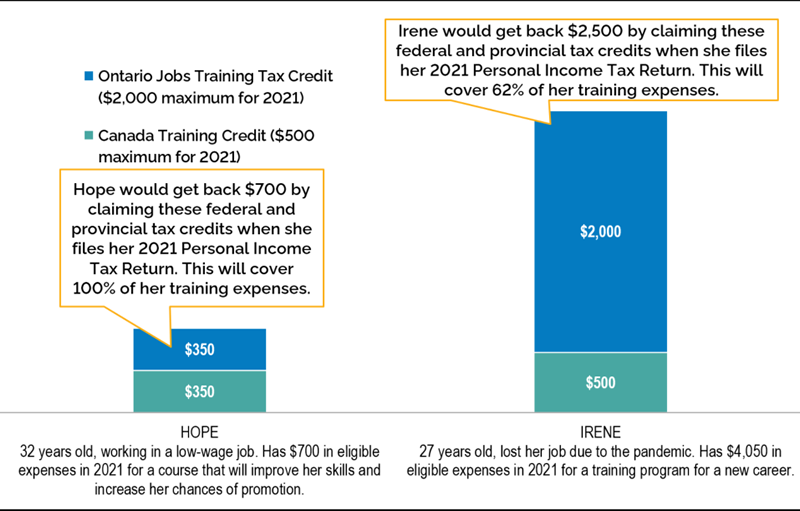

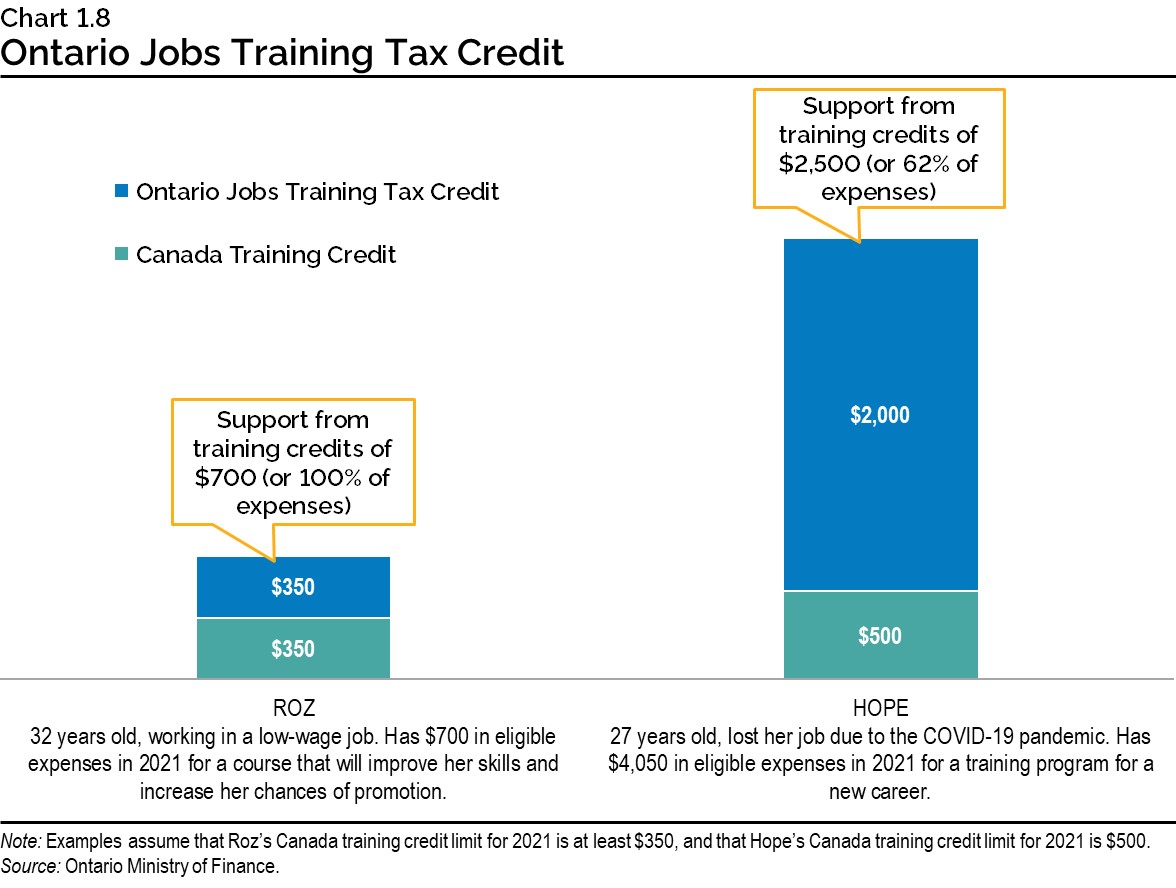

Ontario Jobs Training Tax Credit Smith, Sykes, Leeper & Tunstall LLP

Apprenticeship Training Tax Credit Welch LLP

Are you Eligible for the Disability Tax Credit (DTC)? RDSP

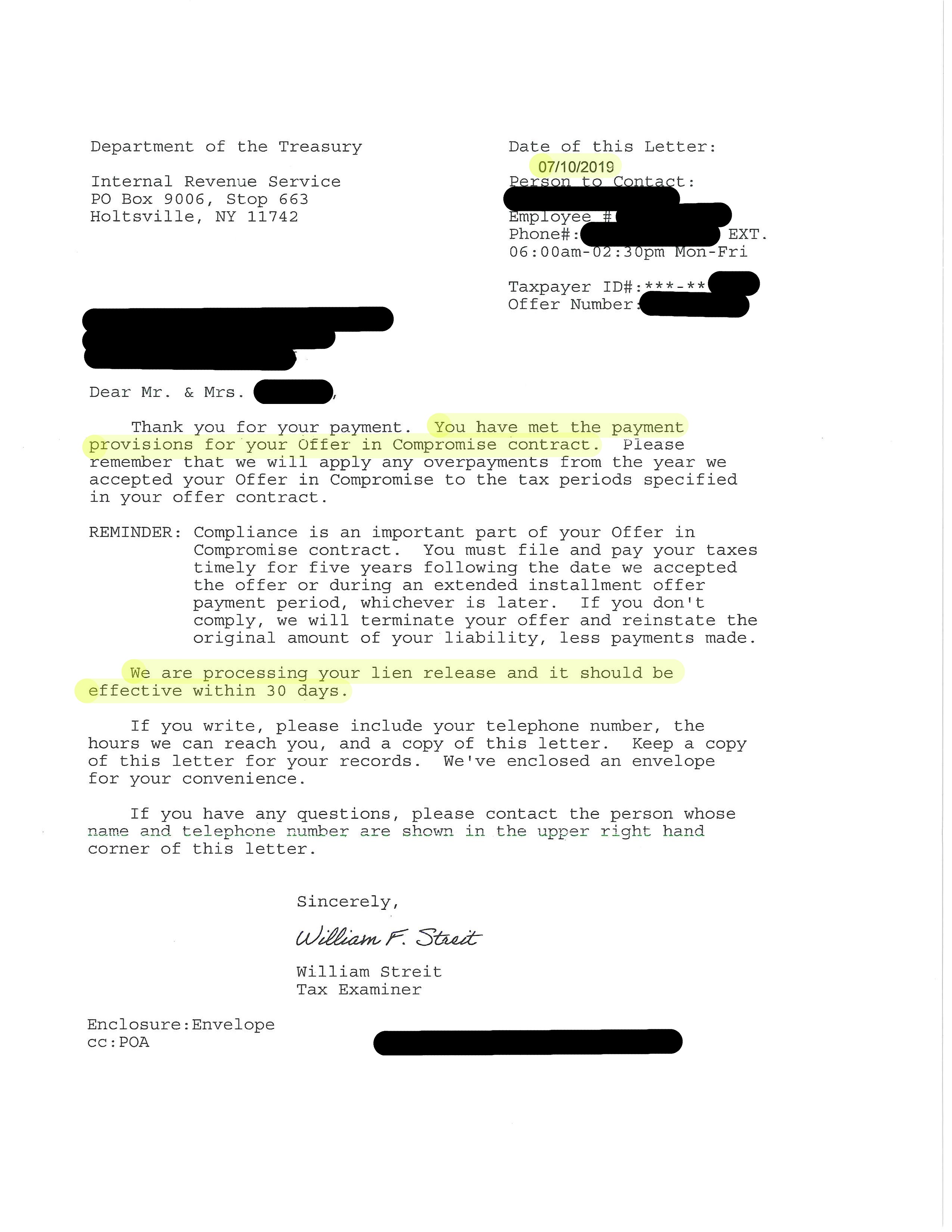

Reconciling Marketplace Advance Payments Bayshore CPA’s, P.A.

Eligibility Criteria For Training Tax Deductions Inspire Accountants Small Business

Deep Study of Tax Credit Disclosures in Annual GST Returns

2021 Ontario Budget Chapter 1B

Tax Credit Laws Turn Your Arizona Tax Liability Into A Scholarship For Children. APSTO

BC Tax Helps Client Save 36,600 BC Tax

.jpg)

BC Extends Tax Credits for Apprentices and Employers

Alameen Post Current News and Articles

R & D Tax Credit Calculator How much can you claim? RAndD Tax

Federal Apprenticeship Job Creation Tax Credit and the BC Training Tax Credit Clearline

Form T2 Schedule 428 Fill Out, Sign Online and Download Fillable PDF, Canada Templateroller

Watch CBS Mornings Child tax credit set to expire Full show on Paramount Plus

Should I Opt Out of Monthly Child Tax Credit Payments? Certifiably Financial

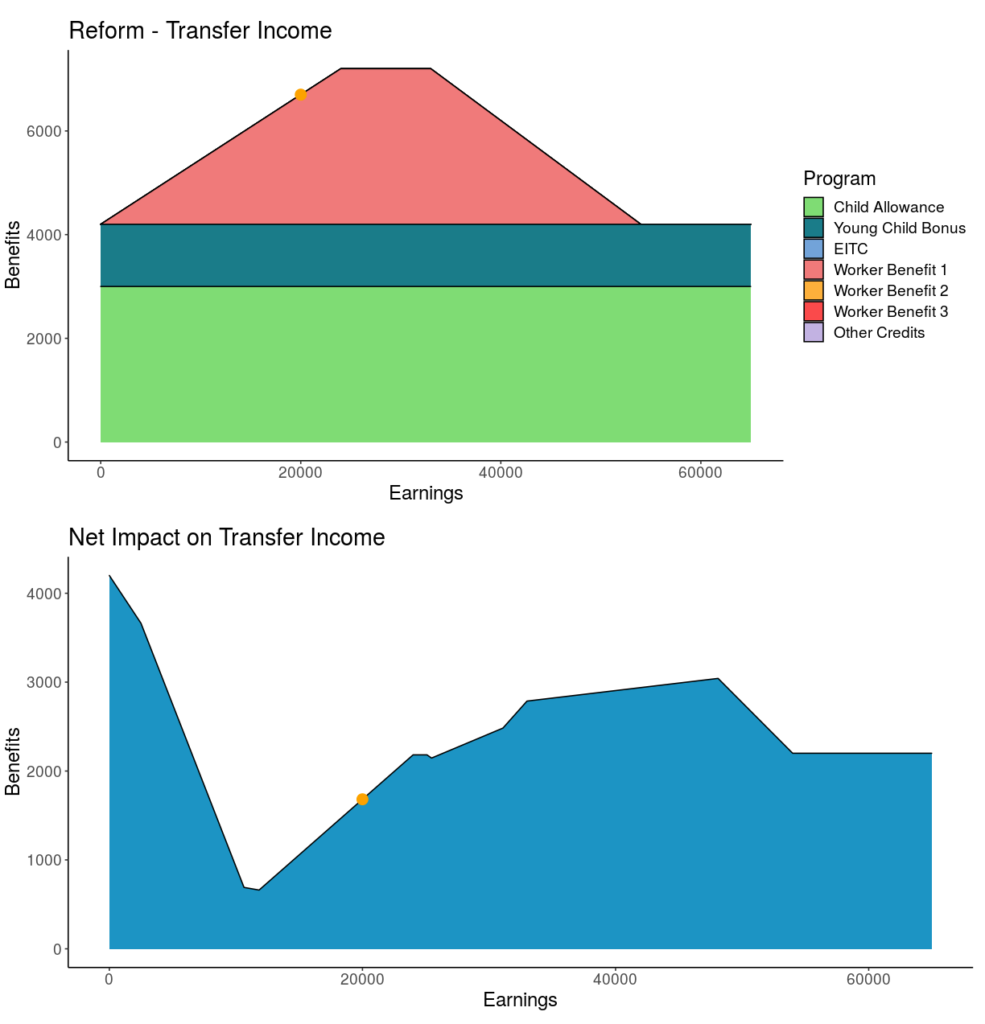

Introducing the Tax Credit Reform Calculator Niskanen Center

منظور از اعتبار مالیاتی ارزش افزوده چیست و چه مزایایی دارد؟ حسابدار ما

Recovery Rebate Tax Credit Guidelines 2023 How to File for the Stimulus Tax Credit 🔶 TAXES S2

The AJCTC is a non-refundable investment tax credit equal to 10% of the eligible salaries and wages payable to eligible apprentices in respect of employment after May 1, 2006. The maximum that an employer can claim is a credit of $2,000 per year for each eligible apprentice. An eligible apprentice is someone who is working in a prescribed trade.. The training tax credit provides refundable income tax credits for businesses that employ apprentices. Sole proprietors, partnerships and corporations can claim the employer’s tax credit. You claim the credit based on the salary and wages you pay to an employee enrolled in an apprenticeship program administered through SkilledTradesBC .